It’s good when you have choices in life. Strawberry or chocolate ice cream? A blue or pink polo? A trip to Bohol or Boracay? Choices provided us more opportunities to actually enjoy ourselves. And for finance assistance, QLO has 2 options you can choose from – a Cash Advance or a Salary Loan. But the question is, which one should you go for?

One of the things you’ll have to think about is how much you’ll need. If it’ll cost you not more than Php 8,000.00, then the Cash Advance service is your best option. However, if you’ll be needing more than this, then the best route to take is to apply for a Salary Loan.

SALARY LOAN

CASH ADVANCE

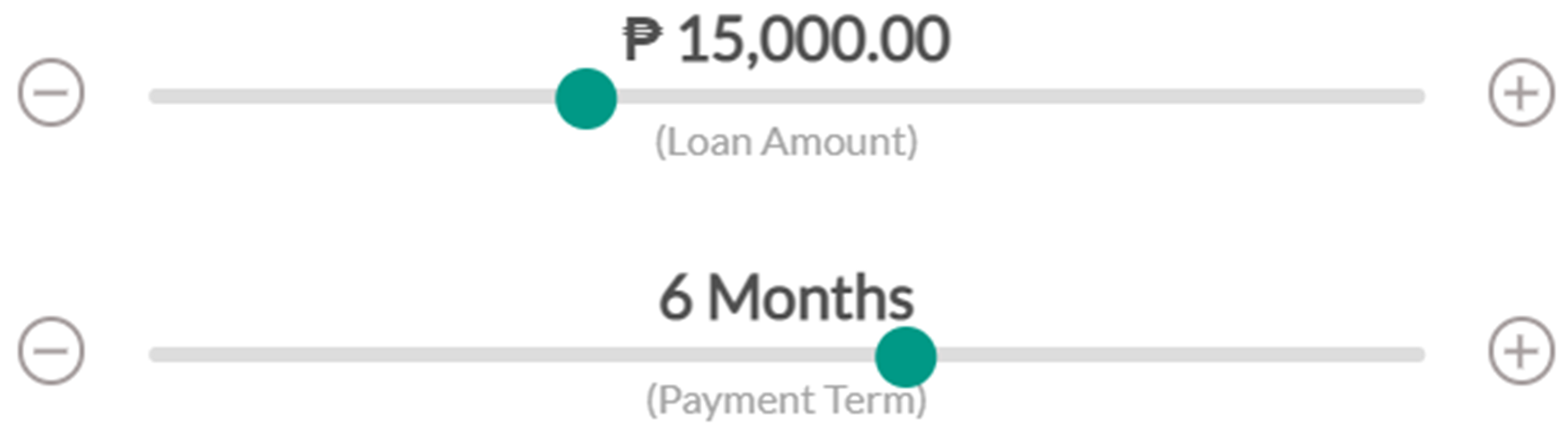

Have a loan amount in mind? Great! Now it’s time to think about payment terms. Are you the type of person who’s eager to pay up immediately? Then, you should definitely go for Cash Advance as its payment term is only up to 1 month. On the other hand, if you want a little more room to pay up, then Salary Loan is you best bet. It has flexible terms from up to 12 months!

Loan Amount? Check! Payment Terms? Check! Last on our checklist is your preffered interest rate. If you want to have zero interest fees, then definitely go for Cash Advance! Easy as that! But if you’re opting to pay for longer, that will incur interest fees. And that route is through Salary Loan.

CASH ADVANCE

Borrow up to P8,000 immediately Pay in 1 month with 0% interest

SALARY LOAN

Borrow more than 8,000 Pay up to 12 months With Additional Fees

Whatever you end up choosing, both QLO services are good options to know, especially when emergency strikes. Want to know more? Simply head on over to qlo.com.ph to read through our helpful FAQs!