We all have our financial goals – whether it is to save for retirement, pay off debt, or start investing. One key secret of many financially successful people is they all have monthly budgets.

By having a set and structured budget, you can have the power to assess which part of your lifestyle you should be adjusting and working on to achieve your goals. Today, we will share the most crucial points in factoring in when making your budget to help you know if you’re on the right track!

Here are the steps to get you started to having an effective monthly budget.

Step 1: List Down Your Mandatory Expenses

To start, you will need to get a piece of paper or open your computer and write down your expenses. There are two types of expenses.

The first one are fixed expenses that have a set value each month like your wifi subscription, phone bill, monthly rent, and required family contributions.

The second one is your variable expenses. These are expenses that are recurring monthly but change in value based on consumption like electricity, transportation, food, and more. Once you’ve identified these items, assess your average spending per item in

Step 2: Compare your Income with your Expenses

After summarizing all your expenses, write down your income sources. How much do you take home per month after salary deductions are made?

You then need to compare your income with your expenses. Use the formula INCOME – EXPENSES in assessing your financial health.

Ideally, you should be earning more than what you’re spending. If this is the case, then great! You can now focus on creating a better financial portfolio. However, if you got a negative value, then you might need to consider adjusting your spendings or increasing your income.

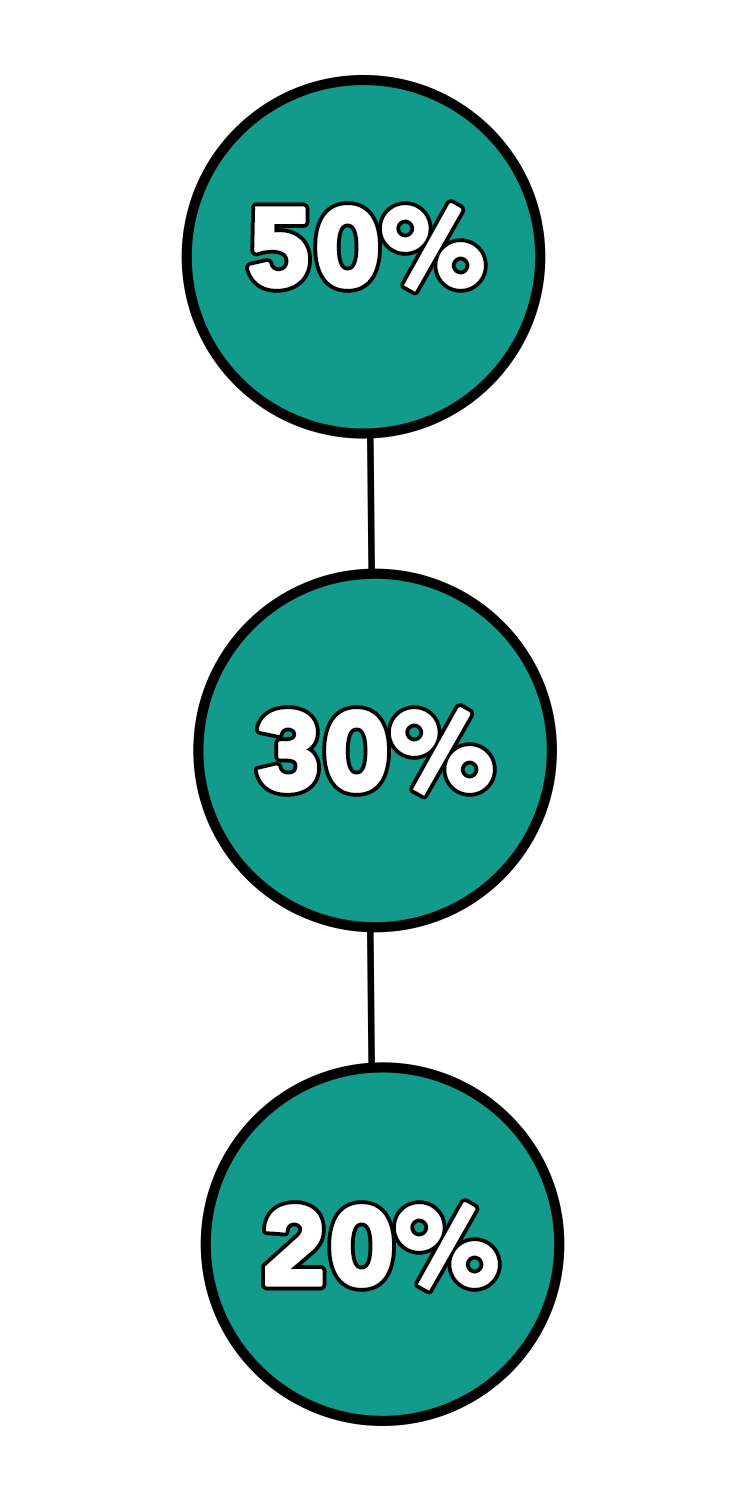

Step 3: Apply the 50-30-20 Rule and the Pay Yourself First Principle

In a 50-30-20 budget, we break down your budget into three parts, needs or essential expenses which should be 50%, wants consume the 30%, and savings and debt repayment use up the last 20% of the budget.

After identifying the three parts of your budget, it is important to understand the “Pay Yourself First” principle which prioritizes saving first before spending the remaining on needs and wants. This principle will help you improve your finances greatly and allow you to invest and make your money work for you in the long run.

Step 4: Define Your Goal Lifestyle

What are your wants? What investments do you wish to aim for? Where do you see yourself after retirement? Do you want to own your own house one day?

Setting financial goals is as important as understanding your budget. Find the time to sit down and assess what you really want to achieve in 1, 3, 5, and 10 years.

Step 5: Adjust Your Lifestyle

Now that you know your current financial standing and your goals, it is time to work on it. Here are some questions you can ask yourself.

- Can you cut down on expenses?

- Can you increase your income or add another source of income?

- How much do you need to earn to achieve your wants if it exceeds 30% of your budget?

- What is the most sustainable way to pay off debt and loans? Do you have the option to do salary deduction?

Once you are done with these steps, you can now write down your budget and make sure to follow it consistently. Remember that a written budget won’t work unless the budget you set out for is “lived.”